Business Expenses Deduction 2024 Calendar – Ready or not, the 2024 tax filing season is here During the pandemic, for the calendar years of 2021 and 2022, business owners were temporarily allowed to deduct 100% of the cost of work-related . Stay updated on the standard deduction amounts for 2024, how it works and when to claim it. Aimed at individual filers and tax preparers. .

Business Expenses Deduction 2024 Calendar

Source : fazzaripartners.comKeystone CPA, Inc. | Fullerton CA

Source : www.facebook.comEvent Listing Request Form Public Submission Event Calendar

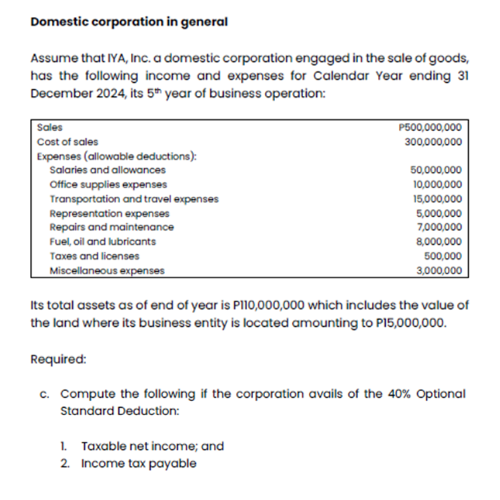

Source : business.whittierchamber.comSolved Domestic corporation in general Assume that IYA, Inc

Source : www.chegg.comTax Checklist — Conrad Associates LLC.

Source : www.conradassociates.comThe Ultimate 2024 Tax Deductions Checklist for Insurance Agents

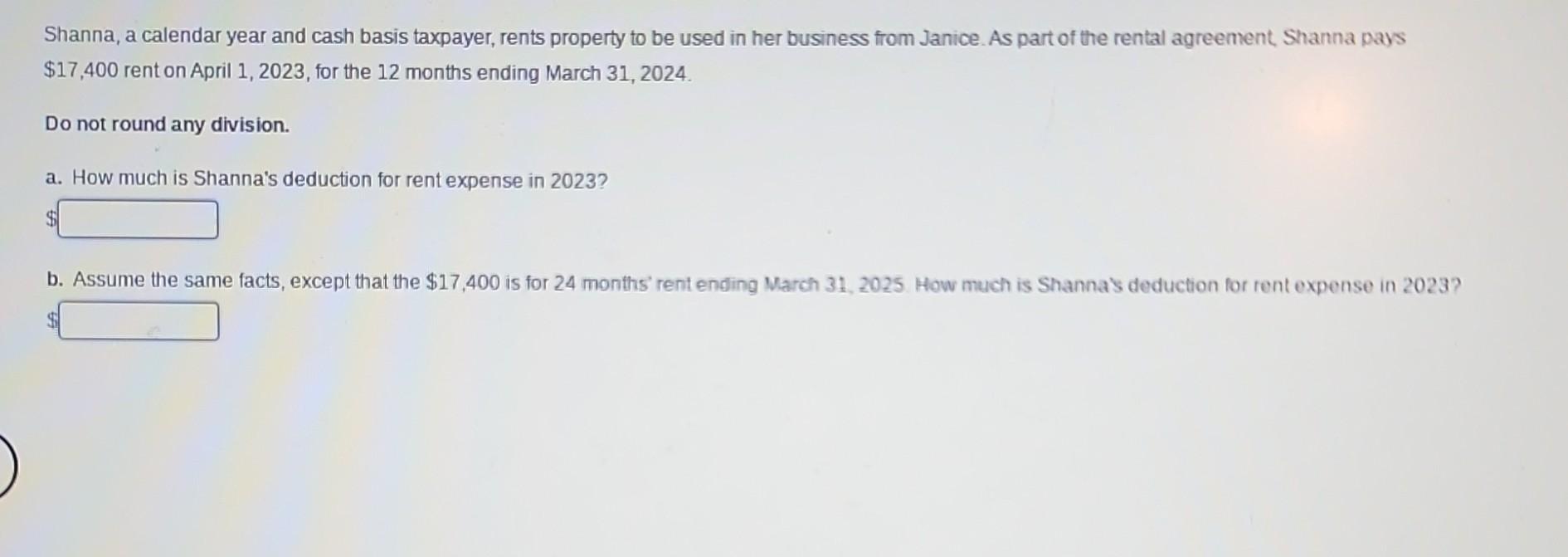

Source : blog.newhorizonsmktg.comSolved Shanna, a calendar year and cash basis taxpayer, | Chegg.com

Source : www.chegg.comStyles & Associates Accountancy | Alton

Source : www.facebook.comSmall business tax preparation checklist 2024

Source : quickbooks.intuit.comSpivey’s Tax & Financial Services, Inc. | Houston TX

Source : www.facebook.comBusiness Expenses Deduction 2024 Calendar 2024 Calendar Year Updates – Allowances, Payroll Rates : The Internal Revenue Service allows you to deduct office expenses from your business income before calculating ink cartridges, pens, desk calendars, tape, light bulbs, cleaning materials . Not only will this make paying employees and vendors easier but it will also help you maximize deductions come tax time. Learn more about our top business expense tracker picks to see which one .

]]>